Standards That Work

Accounting standards that work provide relevant information to investors, lenders, citizens, and other financial statement users, helping them make better-informed decisions—decisions about whether to provide capital, lend or donate money, or support a voter referendum.

But for an accounting standard to work, people must be able to consistently understand it and correctly apply it. Therefore, our work doesn’t end when a final standard is issued. In some ways, it’s just beginning.

The FASB, the GASB, and the FAF want accounting standards to work for everyone. That is why the FASB and the GASB strive to help stakeholders implement their standards. The FAF participates by supporting the FASB and the GASB and by monitoring stakeholder perceptions of the standard-setting process.

From the stock market to the voting booth, standards that work result in better-informed decisions—decisions that affect the quality of people’s lives. Here is how we ensure standards work, and the important role our stakeholders play in that process.

Messages from the FAF, FASB, and GASB Leaders

Advisory Groups

Advisory and other groups provide critical input to the FASB and the GASB. Complete membership rosters for each group are available by clicking on the icons below. View All

Bonus Videos

Standards That Work: FASB

“We view quality implementation as critical to the overall success of a project. The greatest standard in the world won’t improve financial reporting if it can’t be reasonably applied or understood by preparers, auditors, or users.”

For the FASB, “continuous improvement” means ensuring that standards provide investors with better information at the right time. It means educating stakeholders and making clear “what we meant” when we issued a standard to reduce uncertainty around it. And it means continually communicating with stakeholders throughout the process to better understand the costs of a standard—which helps us make better decisions.

Stakeholder engagement is at the heart of that process. In 2017, that engagement focused on helping all our stakeholders understand and successfully implement major—and not-so-major—standards.

RESOURCES

Resource

Groups

items for formal

and informal

advisory groups

(FASB webcasts,

external

conferences)

Inquiry

Service

meetings about

implementation

issues / status

updates

HOW WE HEARD FROM OUR STAKEHOLDERS IN 2017

meetings

letters

NUMBERS:

IMPLEMENTATION

SUPPORT In 2017, the FASB

and its staff...

implementation

issues during 8 public Board

meetings

roundtables

discussions with 51 investors on

implementation

issues

reduce cost and/or

complexity of

existing standards

discussions about

implementation

issues

Standards That Work: GASB

“The GASB’s work doesn’t stop with the issuance of a new standard— and in many ways, at that stage, it’s only begun. We work hard to make sure you have the appropriate tools to understand and implement the Board’s guidance.”

For the GASB, input from those who use, prepare, or audit state and local government financial reports is critical to developing standards that work. That’s why the GASB engages in robust stakeholder outreach throughout the duration of a project—a process that continues even after a final statement is issued.

In 2017, GASB stakeholders shared their views—and their questions—through comment letters, surveys, roundtables, technical inquiries, meetings, and other means of communication. Their input helped the GASB ensure standards provide citizens, investors, and other financial statement users with relevant information for better-informed decisions.

TECHNICAL INQUIRIES

a total of 1,282 technical inquiries

in 2017

HOW WE RECEIVED TECHNICAL INQUIRIES

![]()

![]()

![]()

![]()

STAKEHOLDER

OUTREACH

letters

activities

force meetings

participants

and surveys

GASB members and

staff presented

and users

Supporting the Boards That Set Standards That Work: FAF

While the FASB and the GASB set the standards that constitute Generally Accepted Accounting Principles (GAAP), the FAF works to provide a solid foundation for their success. The FAF Trustees are responsible for providing oversight and promoting an independent and effective standard-setting process. The FAF management is responsible for providing strategic counsel and services that support the work of the standard-setting Boards.

of years of professional

experience of a

FAF Trustee

2017 BY THE NUMBERS: FAF OVERSIGHT AND MANAGEMENT

Diverse Professional Experience: FAF Board of Trustees

Investors

Practitioners

In 2017, the FAF published:

In 2017, the FAF Facilities staff

prepared a total of:

In 2017, the FAF Information Resource Center responded to:

In 2017, the FAF Public

Affairs staff issued:

In 2017, the FAF Public

Affairs facilitated:

Message from the FAF Chairman

and FAF President and CEO

Our collective mission is the establishment and improvement of high-quality financial accounting and reporting standards. A part of that mission is engaging with stakeholders to ensure that the standards work for investors, lenders, donors, citizens, academics, and other financial statement users who need an accurate picture of an organization’s financial condition and performance. The standards should also work for preparers, auditors, and other practitioners, so they can understand and apply the standards properly.

The standard-setting Boards—the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB)—are front and center in making standards work.

Meanwhile, in their stewardship role, the Financial Accounting Foundation (FAF) Board of Trustees makes sure the FASB and the GASB follow an independent and comprehensive standard-setting process. We also identify and appoint highly skilled people to those Boards.

In its support role, the FAF management team provides strategic counsel and ensures the Boards have the infrastructure and resources they need to successfully carry out their missions.

In 2017, both FAF roles were critical to helping the Boards ensure that standards work.

When the FAF Board of Trustees exercises effective oversight, the standard-setting Boards are more successful. That oversight includes ensuring that the Boards’ standard-setting processes work effectively.

For example, in 2017, the Board of Trustees completed its review of the GASB scope of authority consultation process policy. Introduced in 2013, the policy set forth a process for ensuring the GASB was addressing issues within the scope of its standard-setting mission. The Board of Trustees’ review found the policy strikes the right balance by maintaining the independence of the GASB, while ensuring appropriate oversight by the Trustees.

During the Board of Trustees’ quarterly public meetings, FASB and GASB members discuss their activities and progress. These dialogues are important to the oversight process. The robust dialogues provide the FAF Trustees (and stakeholders who attend or watch the meetings online) fresh insights about Board strategy and direction. Several conversations this year centered on the FASB and GASB’s outreach to stakeholders. This provided the Board of Trustees with clear evidence that stakeholder outreach processes in place are working as intended.

In 2017, the Trustees also made several appointments to the FASB, the GASB, and their respective advisory councils. Part of making standards work is understanding that the Boards don’t just need skilled standard setters, they need skilled communicators. We are confident that the appointees have demonstrated leadership in communication and stakeholder engagement—and a commitment to making standards work.

Finally, the Trustees worked hard to promote and protect the independence of the Boards and the standard-setting process. The Trustees make sure that the organizations reach out on an ongoing basis to elected and political leaders to educate them about our ongoing activities and discuss how the Boards can better serve investors and other users of financial statements. In 2017, the Trustees continued the tradition of meeting with key stakeholders on Capitol Hill, in the Administration, and at relevant industry groups.

Our 2017 brand reputation study provided us with valuable insights about stakeholder perceptions of the FASB and GASB’s standard-setting processes. Early in the year, we surveyed thousands of our stakeholders about their perceptions of FAF, FASB, and GASB performance, and how we can improve. More than 1,600 diverse stakeholders responded. The FAF, FASB, and GASB learned much from the study, and the data immediately helped us further improve the way (and what) we are communicating with stakeholders.

On the infrastructure front, the FAF management team continued to make significant progress on a multi-year information technology (IT) transformation project. This initiative is creating the technology tools the standard-setting Boards need to carry out their responsibilities more effectively and efficiently. In 2017, the FAF management team built a customer relationship management platform that helps the Boards better engage with their stakeholders. With FASB and GASB members and staff delivering hundreds of speeches around the country each year, the speaker request portal was also upgraded. Now available through the FASB, GASB, and FAF websites, the portal guides stakeholders, step by step, through the process of requesting FASB, GASB, and FAF speakers.

Lastly, the FAF management team is assessing our publishing and content fulfillment and distribution platforms. Given the age of our current content platform and the changing trends in publishing, this assessment will ensure that our stakeholders continue to get what they need from the FASB and the GASB in an effective, timely, and cost-efficient manner.

Although the FAF, FASB, and GASB each have different roles, we’re all committed to the development of high-quality accounting standards and engaging with stakeholders to ensure that the standards work. On behalf of the FAF, thank you for your interest and involvement in our mission.

Sincerely,

Charles H. Noski

Chairman

Teresa S. Polley

President and CEO

FAF Board of Trustees

Pictured from left to right, seated:

Charles H. Noski

Retired Vice Chairman

Bank of America

Nancy K. Kopp

Treasurer

State of Maryland

David C. Villa

Chief Investment Officer

State of Wisconsin Investment Board

Susan J. Carter

Independent Director

BlackRock Equity/Liquidity Mutual Fund Board, Pacific Pension and Investment Institute

Gary H. Bruebaker

Chief Investment Officer

Washington State Investment Board

Christine M. Cumming

Retired First Vice President and Chief Operating Officer

Federal Reserve

Bank of New York

Terry D. Warfield

PwC Professor in Accounting and Richard J. Johnson Chair, Department of Accounting and Information Systems

University of Wisconsin, Madison

Diane M. Rubin

Retired Audit

Partner and Quality Control Partner

Novogradac &

Company LLP

John B. Veihmeyer

Retired Chairman

KPMG International

Teresa S. Polley

President and Chief

Executive Officer

Financial Accounting

Foundation

Pictured from left to right, standing:

T. Eloise Foster

Chair

Maryland Supplemental

Retirement Plans

Kathleen L. Casey

Senior Advisor

Patomak Global

Partners LLC

Jeffrey L. Esser

Executive Director Emeritus

Government Finance Officers Association

Charles M. Allen

Co-Chairman

Crowe Horwath International

Anthony J. Dowd

President and Chief Executive Officer

Fairfield-Maxwell LTD.

Eugene Flood, Jr.

Independent Director

Janus Henderson Group

Myra R. Drucker

Independent Director

Grantham, Mayo, Van Otterloo & Co. LLC

Kenneth B. Robinson

Senior Vice President, Internal Audit and Financial Controls

Exelon Corporation

Ann M. Spruill

Retired Partner

GMO & Co. LLC

OFFICERS

Charles H. Noski

Chairman

Gary H. Bruebaker

Vice Chairman

Christine M. Cumming

Secretary and Treasurer

Teresa S. Polley

President and

Chief Executive Officer

Mary P. Crotty

Chief Operating Officer

John W. Auchincloss

Vice President,

General Counsel and Assistant Secretary

TRUSTEE COMMITTEES

Charles H. Noski,

Chairman

Gary H. Bruebaker,

Vice Chairman

Myra R. Drucker

Nancy K. Kopp

Kenneth B. Robinson

Ann M. Spruill

Terry D. Warfield

Ann M. Spruill,

Chair

Charles M. Allen

Christine M. Cumming

Anthony J. Dowd

Myra R. Drucker

T. Eloise Foster

Kenneth B. Robinson

Diane M. Rubin

Kenneth B. Robinson,

Chair

Gary H. Bruebaker

Susan J. Carter

Christine M. Cumming

Jeffrey L. Esser

John B. Veihmeyer

David C. Villa

Myra R. Drucker,

Chair

Gary H. Bruebaker

Susan J. Carter

Jeffrey L. Esser

Eugene Flood, Jr.

Ann M. Spruill

David C. Villa

Standard-Setting

Process Oversight

Nancy K. Kopp,

Co-Chair

Terry D. Warfield,

Co-Chair

Charles M. Allen

Kathleen L. Casey

Anthony J. Dowd

Eugene Flood, Jr.

T. Eloise Foster

Diane M. Rubin

John B. Veihmeyer

Welcome

During the past year, the FAF Board of Trustees welcomed Kathleen L. Casey, Jeffrey L. Esser and David C. Villa.

Joined January 1, 2018

Kathleen L. Casey

Senior Advisor

Patomak Global

Partners LLC

Jeffrey L. Esser

Executive Director Emeritus

Government Finance Officers Association

David C. Villa

Chief Investment Officer

State of Wisconsin Investment Board

Thank You

During the past year, Ann Marie Petach, Charles S. Cox and John C. Dugan concluded terms on the FAF Board of Trustees. On behalf of the entire organization, we thank them for their outstanding service.

Completed service on December 31, 2017

Ann Marie Petach

(FAF Secretary and Treasurer)

Director

BlackRock Institutional Trust Company

Charles S. Cox

City Manager

City of Farmers

Branch, Texas

John C. Dugan

Former U.S.

Comptroller of the Currency (2005–2010)

Independent Director, Board of Directors

Citi

Message from the FASB Chairman

A standard that works provides information that helps investors, lenders, and other users make better-informed decisions. A standard that works can be consistently understood and applied. Financial statement users get real value from a standard that works—value that justifies the cost incurred to implement it.

You may know of, or participate in, the FASB’s time-tested process for developing standards that work. What you may not know is the process begins long before we add a project to our agenda, and continues long after we issue a final standard. We continually engage with all our stakeholders throughout the entire life cycle of a standard—including those who prepare, use, or audit financial statements of public and private companies, not-for-profit organizations, and even employee benefit plans.

Our agenda consultation project in 2017 showcases this approach. Standards that work begin with a strong technical agenda, which requires that the Board identify the right accounting issues to address. In September 2017, after two years of outreach, the FASB added three new agenda projects. They include projects on distinguishing liabilities and equity, a component of the FASB’s financial performance reporting research project, and a narrow-scope project on segment reporting intended to improve aggregation criteria and segment disclosures.

Diverse stakeholders identified these issues as priorities—and the Board felt they could be successfully addressed through standard-setting solutions with our existing resources in a timely manner.

On the other hand, several projects didn’t make the cut. Either they weren’t priorities or lacked what the Boards viewed as viable standard-setting solutions. Knowing when to say “no” to a project is as important as selecting the right projects—especially when time and resources are limited.

In 2017, we also made standards work by supporting your efforts to implement them.

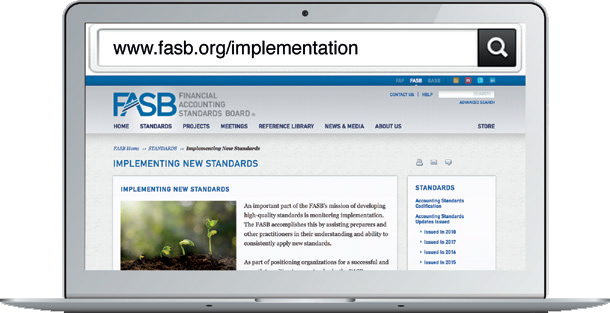

We launched, with some excitement, our first FASB implementation web portal. It’s a “chock-a-block” of information preparers need to implement revenue recognition, credit losses, leases, not-for-profit financial reporting, and other standards. It also features educational videos for investors. Originally suggested by the Financial Accounting Standards Advisory Council (FASAC), the portal is yet another example of the importance of stakeholder input. More than 31,500 page views later, we can safely say it’s been a great success.

Portal visitors can even link directly to our staff specialists through the FASB Technical Inquiry Service. This long-standing resource allows stakeholders to submit technical questions about any of our standards. We rely heavily on this and other tools to shine a light on potential trouble spots that may need additional clarification or even standard-setting action. For example, in 2017, stakeholders expressed concerns around certain aspects of the new leases standard, including land easements and transition approach. The FASB responded by making the guidance less costly and complex to implement. Let me emphasize here that we did this without degrading the quality of information provided to investors.

Finally, in August 2017, we issued a new Derivatives and Hedging standard. To develop it, the FASB considered 60 comment letters, held numerous conference calls with investors and other users of financial statements, and held 2 public roundtables, which included preparers, auditors, regulators, and others. We also met with our Private Company Council to discuss private company hedge documentation issues. The result is a standard that works because all stakeholder audiences were part of the process.

Even so, we didn’t rest on our laurels. When organizations that early adopted the standard had questions about the definition of pre-payable instruments, we clarified it. We also went back to the standard-setting table to update the list of U.S. benchmark interest rates in response to actions taken by the Federal Reserve Board.

In 2018, we will continue to support your success in implementing our standards. We’ll continue to respond to and monitor your questions and—when necessary—resolve issues through more standard setting.

We also will issue a final standard on long-duration insurance contracts, one that will improve financial reporting for those companies in the business of underwriting products like life insurance, disability income, long-term care, and annuities.

Finally, we expect to complete work on our disclosure framework project, meaning we’ll finalize guidelines on how the Board makes decisions. The completed framework promotes consistent decisions by the FASB—over time and regardless of membership—about disclosure requirements, while also guiding reporting organizations in making disclosures.

The FASB is committed to creating standards that work. We encourage you to help us by sharing your views throughout the process, and we thank you for your continued involvement.

Sincerely,

Russell G. Golden, Chairman

Members of the FASB

Pictured from left to right, front row

Harold L. Monk, Jr.

Board Member

Susan M. Cosper

Technical Director

Russell G. Golden

Chairman

James L. Kroeker

Vice Chairman

R. Harold Schroeder

Board Member

Pictured from left to right, back row:

Christine Ann Botosan

Board Member

Marc A. Siegel

Board Member

Marsha L. Hunt

Board Member

2017 FASB Highlights

Key Standards Issued in 2017

- Derivatives and Hedging: Targeted Improvements to Accounting for Hedging Activities

- Accounting for Certain Financial Instruments with Down Round Features

- Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Nonpublic Entities and Certain Mandatorily Redeemable Noncontrolling Interests with a Scope Exception

- Compensation—Stock Compensation: Scope of Modification Accounting

- Receivables—Nonrefundable Fees and Other Costs: Premium Amortization on Purchased Callable Debt Securities

- Compensation—Retirement Benefits: Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost

- Other Income—Gains and Losses from the Derecognition of Nonfinancial Assets: Clarifying the Scope of Asset Derecognition Guidance and Accounting for Partial Sales of Nonfinancial Assets

- Intangibles—Goodwill and Other: Simplifying the Test for Goodwill Impairment

- Not-for-Profit Entities—Consolidation: Clarifying When a Not-for-Profit Entity That Is a General Partner or a Limited Partner Should Consolidate a For-Profit Limited Partnership or Similar Entity

- Business Combinations: Clarifying the Definition of a Business

- Codification Improvements to Topic 995, U.S. Steamship Entities: Elimination of Topic 995

Emerging Issues Task Force Consensuses

Advisory Groups

Advisory and other groups provide important input to the FASB on projects, standards, and implementation efforts. Complete membership rosters for each group are available by clicking on the group's icon below.

Welcome

During the past year, the FASB welcomed Marsha L. Hunt.

Joined July, 1, 2017

Marsha L. Hunt

Prior to joining the

FASB, Ms. Hunt served as Vice

President and Corporate Controller

for Cummins Inc.

Thank You

During the past year, Lawrence W. Smith concluded terms on the FASB. On behalf of the entire organization, we thank him for his outstanding service.

Lawrence W. Smith

Served on the FASB

from July 1, 2007 to

June 30, 2017.

Message from the GASB Chairman

Standards that work give citizens, investors, analysts, and others the information they need to be well-informed about the financial health of state and local governments. Helping orient stakeholders on what our standards mean, and how to implement them, also is critical, and we take this work seriously.

Think of it as a journey that we travel together with our stakeholders. We’re by their side when new standards are far off on the horizon—and when they’re fast approaching. We are with them on the day the standard takes effect and remain with them long after new standards are fully applied.

Education in Action

In 2017, GASB members and staff made more than one hundred in-person presentations across the country to help educate preparers, policymakers, auditors, and users about what new standards are on the horizon. This early engagement gives everyone a chance to prepare with significant lead time. Getting ready for the standards around the healthcare benefits governments provide to their retired employees, for example, was a central theme of those discussions—and will continue to be as governments adopt the new standards.

While these presentations can range from high level to highly detailed, they are tailored to give each audience the knowledge it needs now, when future action is required, and how to get more information.

New OPEB Implementation Guides

Among the best sources for answers to questions about the fast-approaching standards on retiree health-care benefits (which we call Other Post-employment Benefits or OPEB) are the Implementation Guides the Board issued last May on OPEB plan reporting and last December on accounting and financial reporting on OPEB for governments.

Together, these guides answer questions we received at presentations, through the website, by email, on the telephone, and in other ways.

These “Q&As” offer details on how to approach a specific issue to comply with a certain area of the standard. Beyond OPEB, we offer authoritative implementation guidance on many topics, all available at no charge on our website.

Implementation Guides on Fiduciary Activities and Leases Underway

Stakeholder feedback is one of the best ways we have to make sure our standards are working, especially after they have taken effect. As a result of comments from stakeholders, in December the GASB started working on guides for two recent standards: fiduciary activities and accounting for leases.

These standards are important in their own right, but also raise a variety of specific stakeholder questions about how to implement them effectively. We’ll be working to develop these Implementation Guides over much of 2018, and plan to issue drafts toward the end of the year and into early 2019.

New Guidance to Fine-Tune and Clarify Existing Standards

The GASB also works to address issues identified by stakeholders about how already-existing standards are operating. In March 2017, the Board issued Statement No. 85, Omnibus 2017, that fine-tunes and clarifies areas of recent guidance, including such issues as fair value reporting, pensions and OPEB, and blending component units. Statement 85 will help reduce uncertainty and enhance consistency in applying the standards—and should improve how useful they are.

GASB Technical Inquiry System Answers Your Questions

I want to emphasize that standards that work can mean different things to different people. Sometimes, despite all the presentations, Implementation Guides, and additional fine-tuning and clarification, questions remain. It’s understandable, because the nation’s nearly 90,000 state and local governments, while having much in common, also are a cornucopia of unique facets and features.

Given the specific facts and circumstances a government faces, understanding what makes a standard work may require a one-on-one conversation with a member of the GASB staff.

Every year, our staff holds well over 1,000 such conversations to talk through just how our standards apply in a particular case. After studying the standards, exploring the implementation guidance and other related accounting literature, if you still cannot resolve your accounting or financial reporting issue, I would encourage you to reach out to the GASB staff for assistance through our Technical Inquiry System.

Thank You—and Let Us Hear from You!

Without question, the rich input our diverse range of stakeholders provides helps shape, guide, and inform the Board’s activities. In the end, the standards that work the best are the ones in which our stakeholders are most involved. Hearing from you throughout our process is critical to developing standards that work. We appreciate and thank you for your ideas, energy, and involvement—and look forward to continuing to work together this year and beyond.

Sincerely,

David A. Vaudt, Chairman

Members of the GASB

Pictured from left to right, front row

David E. Sundstrom

Board Member

Jeffrey J. Previdi

Vice Chairman

David A. Vaudt

Chairman

Kristopher E. Knight

Board Member

James E. Brown

Board Member

Pictured from left to right, back row:

David R. Bean

Director of Research and

Technical Activities

Brian W. Caputo

Board Member

Michael H. Granof

Board Member

2017 GASB Highlights

Final Statements

Implementation Guides

- Implementation Guidance Update—2017

- Financial Reporting for Postemployment Benefit Plans Other Than Pension Plans

- Accounting and Financial Reporting for Postemployment Benefits Other Than Pensions (and Certain Issues Related to OPEB Plan Reporting)

- Certain Disclosures Related to Debt, including Direct Borrowings and Direct Placements

- Accounting and Financial Reporting for Majority Equity Interests

- Accounting for Interest Cost during the Period of Construction

- Implementation Guidance Update—201Y

Governmental Accounting Standards

Advisory Council (GASAC)

The GASAC is responsible for consulting with the GASB on technical issues on the Board’s agenda, project priorities, matters likely to require the attention of the GASB, selection and organization of task forces, and such other matters as may be requested by the GASB or its chairman. More information about the GASAC—including complete membership roster—is available here.

Welcome

During the past year, the GASB welcomed Kristopher E. Knight.

Joined July, 1, 2017

Kristopher E. Knight

Mr. Knight is Delaware's

deputy secretary of state and

director of the state's Division

of Corporations.

Thank You

During the past year, Jan I. Sylvis concluded terms on the GASB. On behalf of the entire organization, we thank her for her outstanding service.

Jan I. Sylvis

Served on the GASB from

July 1, 2007 to June 30, 2017;

Vice Chair of the GASB from

January 1, 2015 to June 30, 2017.

FASB/GASB: Where We Were in 2017

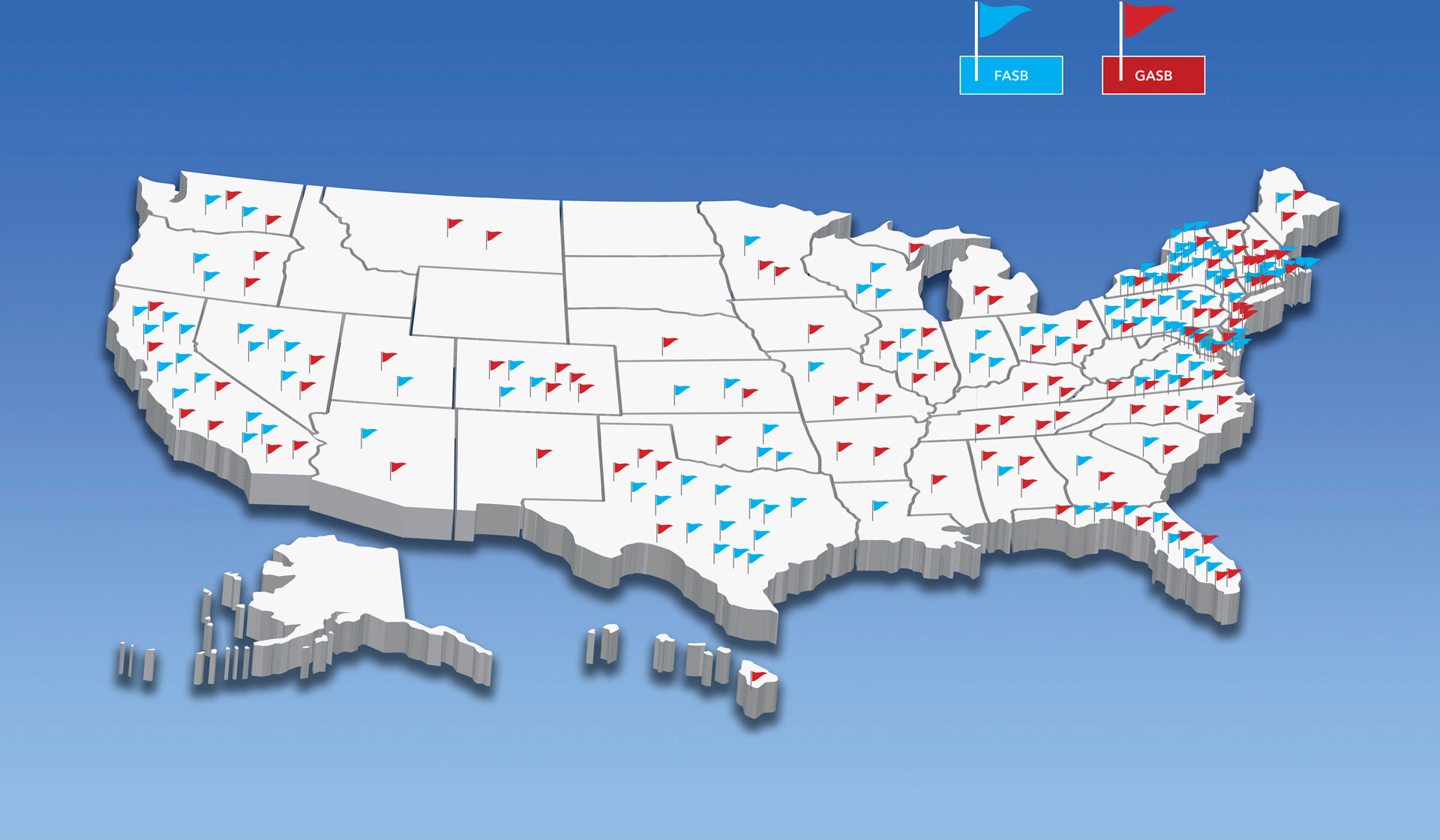

In 2017, representatives of the FASB and the GASB traveled to 46 states (including the District of Columbia) to address stakeholders at events around the country.

About Us

Financial reporting is the language that communicates information about the financial condition and operational results of a company (public or private), not-for-profit organization, or state or local government. Accounting standards determine how those financial statements are prepared. The standards are known collectively as Generally Accepted Accounting Principles—or GAAP.

The Financial Accounting Foundation (FAF) is the independent, private-sector, not-for-profit organization based in Norwalk, Connecticut, responsible for the oversight, administration, financing, and appointment of the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB).

The FASB establishes financial accounting and reporting standards for public and private companies and not-for-profit organizations.

The GASB establishes financial accounting and reporting standards for U.S. state and local governments.

The FASB and the GASB are responsible for ensuring that GAAP remains the high-quality benchmark of financial reporting so that investors, lenders, capital providers, and other users of financial statements have access to the information they need to make better-informed decisions.

Our Mission

The collective mission of the FASB, the GASB, and the FAF is to establish and improve financial accounting and reporting standards so they provide useful information to investors and other users of financial reports and to educate stakeholders on how to most effectively understand and implement those standards.

The FASB, the GASB, the FAF Trustees, and the FAF management contribute to the collective mission according to each one’s specific role:

- The FASB and the GASB are charged with setting the highest-quality standards through a process that is robust, comprehensive, and inclusive.

- The FAF management is responsible for providing strategic counsel and services that support the work of the standard-setting Boards.

- The FAF Trustees are responsible for providing oversight and promoting an independent and effective standard-setting process.

Advisory Groups

Advisory and other groups provide critical input to the FASB and the GASB. Complete membership rosters for each group are available by clicking on the group's icon below.

FASB ADVISORY GROUPS

Financial Accounting Standards Advisory Council

Advises the FASB on issues related to projects on the Board’s agenda, possible new agenda items, project priorities, procedural matters that may require the attention of the FASB, and other matters as requested by the chairman of the FASB. FASAC meetings provide the Board with an opportunity to obtain and discuss the views of a very diverse group of individuals from varied business and professional backgrounds.

Investor Advisory Committee

Provides advice, from the investors’ perspective, on current and potential FASB agenda projects.

Not-for-Profit Advisory Committee

Provides advice on existing guidance, current and proposed technical agenda projects, and longer-term issues related to the not-for-profit sector.

Small Business Advisory Committee

Provides advice on FASB projects related to the operationality and the anticipated costs, complexities, and benefits of potential solutions principally from a small public company perspective.

OTHER KEY FASB GROUPS

Emerging Issues Task Force

The mission of the EITF is to assist the FASB in improving financial reporting through the timely identification, discussion, and resolution of financial accounting issues within the framework of the FASB Accounting Standards Codification®.

Private Company Council

The PCC is the primary advisory body to the FASB on private company matters. The PCC uses the Private Company Decision-Making Framework to advise the FASB on the appropriate accounting treatment for private companies for items under active consideration on the FASB’s technical agenda. The PCC also advises the FASB on possible alternatives within GAAP to address the needs of users of private company financial statements. Any proposed changes to GAAP are subject to endorsement by the FASB.

GASB ADVISORY GROUPS

Governmental Accounting Standards Advisory Council

Consults with the GASB on technical issues on the Board’s agenda, project priorities, matters likely to require the attention of the GASB, and such other matters as may be requested by the GASB. GASAC meetings provide the Board with an opportunity to obtain and discuss views with a broad representation of preparers, auditors, and users of financial information.

GASB Consultative Groups

Groups that are assembled at the discretion of the GASB chairman for pre-agenda research that is expected to be extensive and to address a broad or fundamental portion of the accounting and financial reporting standards.

GASB Task Forces

Task forces that are assembled for most major projects and serve as a sounding board as a project progresses.

Financial Accounting Standards Advisory Council

Advises the FASB on issues related to projects on the Board’s agenda, possible new agenda items, project priorities, procedural matters that may require the attention of the FASB, and other matters as requested by the chairman of the FASB. FASAC meetings provide the Board with an opportunity to obtain and discuss the views of a very diverse group of individuals from varied business and professional backgrounds.

FASAC Chair

Andrew G. McMaster, Jr.

FASAC Executive Director

Alicia A. Posta

Members

Kimber Bascom

Partner

KPMG LLP

Avi Berg*

Portfolio Manager and Analyst

Elm Ridge Capital Management

Stuart Birdt

Wealth Manager

Manchester Capital Management LLC

Rudolph Bless*

Chief Accounting Officer

Bank of America

Susan M. Callahan

Director, Americas Accounting and Global Accounting Policy

Ford Motor Company

Gordon Edwards*

Chief Financial Officer

Marshfield Clinic Health System

Richard E. Forrestel, Jr.

Treasurer

Cold Spring Construction Company, Inc.

Marie T. Gallagher

Senior Vice President and Controller

PepsiCo, Inc.

Sydney Garmong

Partner

Crowe Horwath LLP

Zachary Gast*

Global Head of Research

CFRA

Sameer Gokhale

Senior Director Investor Relations

Fifth Third Bancorp

Elizabeth Graseck*

Managing Director

Research, Morgan Stanley

Jeffrey Hales

Catherine W. and Edwin A. Wahlen, Jr.

Professor of Accounting

Georgia Institute of Technology

Richard R. Jones

Partner — Director of Accounting

EY

Mark LaMonte

Managing Director

Moody’s Investors Service

Sean C. Miller

Senior Vice President—Technical Accounting and Compliance

Sony Pictures Entertainment

Gregg L. Nelson

Vice President and Chief Accounting Officer

IBM Corporation

Douglas R. Oare

Managing Director

BlackRock, Inc.

David Schmid*

Partner

PwC

Cathy Shakespeare

Associate Professor of Accounting

University of Michigan

Sherry M. Smith

Board of Directors

Deere & Company, Tuesday Morning Corporation,

and Realogy Holdings Corporation

Lee Sotos

Senior Analyst

Fidelity Worldwide Investment

Amie Thuener*

Vice President, Chief Accountant

Alphabet

Ted T. Timmermans

Vice President, Controller, and Chief Accounting Officer

The Williams Companies, Inc.

Sharon A. Virag

Chief Financial Officer

NeoGenomics Laboratories, Inc.

Joan E. Waggoner

Partner in Professional Standards

Plante Moran, PLLC

John White*

Partner—Corporate

Cravath, Swaine & Moore, LLP

Thomas W. White

Partner

WilmerHale LLP

Randall Woods

Principal/Head of Investing for Pension Funds

RJW Financial Services

Teri Yohn*

Conrad Prebys Professor of Accounting

Indiana University

*New members in 2018

Completed Service in 2017

R. Scott Blackley

Chief Financial Officer

Capital One

Gary Buesser

Director

Lazard Asset Management

Colleen K. Conrad

Executive Vice President and Chief Operating Officer

National Association of State Boards of Accountancy

Xihao Hu

Executive Vice President, Finance

and Head of Accounting, Tax, Planning and Finance Shared Services

TD Bank

Timothy J. LaSpaluto

Chief Financial Officer

AICPA

Dan Mahoney

Director of Research

CFRA

Maya McReynolds

Vice President Finance and Chief Accounting Officer

Dell Inc.

Daniel S. Meader

Principal

Trinity Private Equity Group LP

John G. Morriss

Senior Vice President, Head of Fixed Income Research, Investment Management

Lincoln Financial Group

Thomas Omberg

National Leader, Financial Accounting and Reporting Services

Deloitte & Touche LLP

Dave Sullivan

National Managing Partner—Quality & Professional Practice

Deloitte & Touche LLP

Jeffrey Wilks

Director and EY Professor

School of Accountancy

Brigham Young University

Louis Zahorak

Investment Director

CalPers

Investor Advisory Committee

Provides advice, from the investors’ perspective, on current and potential FASB agenda projects.

IAC Chair

Susan M. Cosper

Technical Director

Financial Accounting Standards Board

Members

Todd Castagno

Executive Director and Equity Research Analyst

Morgan Stanley

Yoni Engelhart*

Partner

Schilit Forensics

Trevor Harris

Arthur J. Samberg Professor of Professional Practice

Accounting

Columbia Business School

Katherine Hensel

Private Investor

Shripad Joshi

Senior Director

S&P Global Ratings

Brian Kleinhanzl*

Managing Director

Keefe, Bruyette & Woods, Inc.

Jill Lehman

Head of Healthcare and TMT Research

CFRA

Janet Pegg*

Senior Analyst

Zion Research Group

Matt Schechter

Head, Forensic Accounting

Balyasny Asset Management LP

Steven Y. Yang

Investment Analyst

Folger Hill Asset Management

*New members in 2018

Completed Service in 2017

Frederick Cannon

Global Director of Research, Chief Equity Strategist,

and Executive Vice President

Keefe, Bruyette, & Woods, Inc.

Kevin W. Shea

Chief Executive Officer

Disciplined Alpha LLC

David Trainer

Chief Executive Officer

New Constructs LLC

Not-for-Profit Advisory Committee

Provides advice on existing guidance, current and proposed technical agenda projects, and longer-term issues related to the not-for-profit sector.

Committee Chair

Jeffrey D. Mechanick

Assistant Director—Nonpublic Entities

Financial Accounting Standards Board

Members

Alice Antonelli

Director, Advisory Services

Nonprofit Finance Fund

Cathy Clarke

Chief Assurance Officer

Clifton Larson Allen, LLP

Mary Connick

Senior Vice President, Finance & Corporate Controller

Dignity Health

Jim Croft

Principal

JWC Consulting Group

Formerly Executive Vice President

and Chief Financial Officer

The Field Museum of Natural History

Michael Forster

Chief Operating and Chief Financial Officer

Woodrow Wilson International Center for Scholars

Kelly Frank

CPA, Partner

Crowe Horwath LLP

David Gagnon

Partner, Audit

National Industry Leader, Higher Education and Other Not-for-Profits

KPMG LLP

Deborah Gillespie

Vice President, Finance and Administration and Secretary/Treasurer

The Joyce Foundation

John D. Griffin*

Senior Vice President and Controller

AARP

David C. Horne*

Chief Financial Officer

Island Peer Review Organization

Former Chief Financial Officer

March of Dimes

Kim E. Keenoy*

Vice President, Senior Portfolio Management Officer

Bank of America Merrill Lynch

John Kroll

Associate Vice President for Finance

The University of Chicago

Kimberly K. McKay*

Managing Partner

BKD, LLP

Carolyn Mollen

Vice President and Chief Financial Officer

Independent Sector

Dennis Morrone

Partner-in-Charge, National Not-for-Profit Audit Practice

Grant Thornton LLP

Andrew Prather

Shareholder

Clark Nuber PS

Amy B. Robinson

Vice President, Chief Financial Officer and Chief Administrative Officer

The Kresge Foundation

Tammy R. Waymire*

Associate Professor

Middle Tennessee State University

*New members in 2018

Observers

Dena Markowitz

Chief, Division of Investigations

Pennsylvania Bureau of Charitable Organizations

(representing National Association of State Charity Officials)

Christopher Cole

Senior Technical Manager and Not-For-Profit Expert Panel Staff Liaison

AICPA

Completed Service in 2017

Harvey Dale

University Professor of Philanthropy and the Law

Director, National Center of Philanthropy and the Law

New York University School of Law

Norman C. Mosrie

Partner

Dixon Hughes Goodman (DHG)

Linda M. Parsons

Associate Professor of Accounting

Culverhouse School of Accounting

University of Alabama

Bennett M. Weiner

Chief Operating Officer

Better Business Bureau Wise Giving Alliance

Small Business Advisory Committee

Provides advice on FASB projects related to the operationality and the anticipated costs, complexities, and benefits of potential solutions principally from a small public company perspective.

Committee Chair

Alicia A. Posta

Assistant Director

Financial Accounting Standards Board

Members

Gary J. Bachman

Chief Operating Officer

Pzena Investment Management, Inc.

Tim Caffrey

President

Ty View Capital

Rick Day

National Director of Accounting

RSM US LLP

John Exline

Chief Financial Officer

Clark Investment Group

David Gonzales

Vice President — Senior Accounting Analyst

Moody’s Investors Service

K. Scott Gray*

Senior Vice President and Chief Financial Officer

Luby’s, Inc.

Shannon Greene

Chief Executive Officer

Tandy Leather Factory, Inc.

David W. Hinshaw

Managing Partner, Professional Standards Group and SEC Practice

Dixon Hughes Goodman LLP (DHG)

Robert Hoffman

Chief Financial Officer and Senior Vice President, Finance

Heron Therapeutics

Cortney Johnson

Chief Financial Officer

All Web Leads, Inc.

Dominick Kerr*

Director—Global Accounting Practice

Connor Group

Greg Kowieski

Partner

Moss Adams LLP

Ryan LaFond*

Deputy Chief Investment Officer

Algert Group

Marshall Minoux

Underwriting Director/Construction Services

Travelers

Doug Reynolds

Partner, National Professional Consulting Group

Grant Thornton

Robert B. Vogt

Partner, Professional Practice Group

EY

John Zimmer

Managing Director

First Lake Advisors

*New members in 2018

Completed Service in 2017

William Waller

Portfolio Manager/Managing Member

M3 Funds, LLC and M3

Emerging Issues Task Force

The mission of the EITF is to assist the FASB in improving financial reporting through the timely identification, discussion, and resolution of financial accounting issues within the framework of the FASB Accounting Standards Codification®.

EITF Chair

Susan M. Cosper

Technical Director

Financial Accounting Standards Board

EITF Coordinator

Thomas Faineteau

Practice Fellow

Financial Accounting Standards Board

Members

Kimber Bascom*

Partner

KPMG LLP

Paul A. Beswick

Partner

EY

James G. Campbell

Corporate Controller

Alphabet Inc.

Terri Z. Campbell

Founder

Archer Bay Capital LLC

Alexander M. Corl

Chief Financial Officer and Treasurer

The Lee Company

Lawrence Dodyk*

Partner/U.S. Business Combinations Leader

PwC

Bret Dooley

Managing Director and Director of

Corporate Accounting Policies Group

JPMorgan Chase & Co.

Carl Kampel

Director in Charge of Professional Standards

Ellin & Tucker, Chartered

Mark LaMonte

Vice President — Senior Credit Officer,

Financial Institutions Group/

Accounting Specialist Group

Moody’s Investors Service

Ashwinpaul C. Sondhi

President

A.C. Sondhi & Associates, LLC

Robert Uhl

Partner

Deloitte & Touche LLP

*New members in 2017

Participating Observers

Sagar Teotia

Deputy Chief Accountant

U.S. Securities and Exchange Commission

James A. Dolinar

Partner

Crowe Horwath LLP

(FinREC Observer)

Yan Zhang

Partner

EisnerAmper LLP

(PCC Observer)

Completed Service in 2017

John M. Althoff

Partner

PwC

Robert B. Malhotra

Partner

KPMG LLP

Lawrence J. Salva

Senior Vice President, Chief Accounting Officer & Controller

Comcast Corporation

Mark Scoles

Partner-In-Charge, Accounting Principles

Grant Thornton LLP

Private Company Council

The PCC is the primary advisory body to the FASB on private company matters. The PCC uses the Private Company Decision-Making Framework to advise the FASB on the appropriate accounting treatment for private companies for items under active consideration on the FASB’s technical agenda. The PCC also advises the FASB on possible alternatives within GAAP to address the needs of users of private company financial statements. Any proposed changes to GAAP are subject to endorsement by the FASB.

PCC Chair

Candace Wright

Director

Postlethwaite & Netterville

FASB Liaison

Harold L. Monk, Jr.

Member

Financial Accounting Standards Board

PCC Coordinator

Michael K. Cheng

Senior Project Manager

Financial Accounting Standards Board

Members

Timothy J. Curt

Managing Director and Partner

Warburg Pincus LLC

Jeremy Dillard*

Partner

SingerLewak LLP

David J. Hirsch

Vice President, Finance

Pritzker Group Private Capital

David Lomax

Assistant Vice President and

Underwriting Officer

Liberty Mutual Insurance Company

Michael Minnis*

Associate Professor

University of Chicago Booth School of Business

Richard Reisig

Shareholder and Technical Director, Attest Services

Anderson ZurMuehlen & Company, PC

Dev Strischek*

Principal

Devon Risk Advisory Group

Frank Tarallo*

Chief Executive Officer

Theragenics Corporation

Beth I. van Bladel

Director

CFO for Hire LLC

Yan Zhang

Partner

EisnerAmper LLP

*New members in 2018

Completed Service in 2017

Steven Brown

Credit Risk Manager and Senior Vice

President

US Bank

Jeffery Bryan

Partner, Professional Standards Groups

Dixon Hughes Goodman LLP (DHG)

Lawrence E. Weinstock

Vice President—Finance

Mana Products, Inc

Governmental Accounting Standards Advisory Council

Consults with the GASB on technical issues on the Board’s agenda, project priorities, matters likely to require the attention of the GASB, and such other matters as may be requested by the GASB. GASAC meetings provide the Board with an opportunity to obtain and discuss views with a broad representation of preparers, auditors, and users of financial information.

GASAC Chairman

Robert W. Scott

Director, Finance

City of Brookfield, Wisconsin

(Nominated by the Government Finance Officers Association)

GASAC Vice Chairman

Alan Skelton

State Accounting Officer

State of Georgia

(Nominated by the National Association of State Auditors, Comptrollers and Treasurers)

Members

Peggy Arrivas*

Associate Vice President and Systemwide Controller

University of California

(Nominated by the National Association of College and University Business Officers)

Robert Balducci*

Comptroller

New York City Bond Financing Entities

(Nominated by the U.S. Conference of Mayors)

Benjamin Barnes

Secretary, Office of Policy and Management

State of Connecticut

(Nominated by the National Governors Association)

Patsy Brown*

Director of Accounting

Chesterfield County, Virginia

(Nominated by the National Association of Counties)

Thad Calabrese*

Associate Professor

Robert F. Wagner Graduate School of Public Service

New York University, New York

(Nominated by the Association for Budgeting and Financial Management)

Alan D. Conroy

Executive Director

Kansas Public Employees Retirement System

(Nominated by the Council of State Governments)

Wayne D. Gerhold

Principal

Law Offices of Wayne D. Gerhold

(Nominated by the National Association of Bond Lawyers)

Brian Green

Partner, Healthcare Audit and Reimbursement Services

Seim Johnson

(Nominated by the Healthcare Financial Management Association)

Demetria Hanna

Branch Chief, Economic Statistical Methods Division

U.S. Census Bureau

(Nominated by the U.S. Census Bureau)

Shirley D. Hughes

City Administrator

City of Liberty, South Carolina

(Nominated by the International City/County Management Association)

Paul Kwiatkoski*

Managing Director, Public Finance Sector

Kroll Bond Rating Agency

(Bond Rater)

James Lanzarotta

Partner

Moss Adams

(Nominated by the American Institute of Certified Public Accountants)

Gerard Lian

Senior Analyst, Fixed Income Team

Invesco

(Nominated by the Investment Company Institute)

David H. Lillard, Jr.

Treasurer

State of Tennessee

(Nominated by the National Association of State Treasurers)

Angus Maciver*

Legislative Auditor

State of Montana

(Nominated by the National Conference of State Legislatures)

Lealan Miller

Director, Government Services

Eide Bailly

(Nominated by the Association of Government Accountants)

Sandra Moorman

Director of Accounting and Controller

Sacramento Municipal Utility District, California

(Nominated by the American Public Power Association)

B. Sue Osborn

Mayor

City of Fenton, Michigan

(Nominated by the National League of Cities)

Terry Patton*

Robert Madera Distinguished Professor of Accounting

Dillard College of Business Administration

Midwestern State University, Texas

(Nominated by the American Accounting Association)

Mark Pepera

Chief Financial Officer

Brunswick City Schools, Ohio

(Nominated by the Association of School Business Officials International)

Robert M. Reardon

Senior Investment Officer

State Farm Insurance Company

(Nominated by the Insurance Industry Investors)

Tasha Repp

Business Assurance Partner, Tribal Services Group

Moss Adams

(Nominated by the Native American Finance Officers Association)

Phyllis Resnick

Lead Economist and Deputy Director

Colorado Futures Center at Colorado State University

(Nominated by the Governmental Research Association)

Gilbert L. Southwell III

Vice President and Senior Municipal Analyst

Wells Capital Management

(Nominated by the National Federation of Municipal Analysts)

Larry Stafford

Audit Services Manager

Clark County, Washington

(Nominated by the Association of Local Government Auditors)

James R. Wells

Director, Governor’s Finance Office

State of Nevada

(Nominated by the National Association of State Budget Officers)

Robert A. Wylie

Executive Director

South Dakota Retirement System

(Nominated by the National Association of State Retirement Administrators)

*New members in 2018

Official Observer

Robert Dacey

Chief Accountant

(Representing the Comptroller General of the United States)

Government Accountability Office

Completed Service in 2017

Stephen Klein

Chief Fiscal Officer, Legislative Joint Fiscal Office

State of Vermont

Jacqueline L. Reck

James E. Rooks and C. Ellis Rooks Distinguished Professor of Accounting

School of Accountancy

University of South Florida

Daniel Smith

Associate Professor and Program Director—MPA

School of Public Policy and Administration

University of Delaware

Charles A. Tegen

Associate Vice President

Clemson University, South Carolina